nassau county property tax rate 2020

The five-year phase-in was approved in March 2020. On February 15 th 2022 the Nassau County Treasurer will sell at public on-line auction the tax liens on certain real estate unless the owner.

Harris County Tx Property Tax Calculator Smartasset

Nassau County Annual Tax Lien Sale - 2022.

. Search Valuable Data On A Property. Look Up Property Records. Please see further explanations herein.

Start Your Homeowner Search Today. Delinquent School Taxes are collected by the Treasurers Office beginning June 1st and delinquent General Taxes are collected by the Treasurers Office beginning September. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900.

The Azizollahoffs said they were shocked by their first tax bill for 2020-21. His total school tax bill rose by nearly 1200 from 8494 last year to 9691 online county records show. Request Your Tax Grievance Form Today.

Schedule a Physical Inspection of Your Property If. Start Your Nassau County Property Research Here. You can visit their website for more information at Nassau County Property Appraiser.

The public information contained herein is furnished as a public service by Nassau County for use. What the RPIA Does. Krauss valuation was 638000 for 2020-21 compared with.

4 discount if paid in the month of November. On March 23 2020 the Nassau County Legislature passed the Reassessment Phase-In Act of 2020 RPIA formerly known as the Taxpayer Protection Plan. Nassau county collects on average 179 of a propertys assessed fair market value as property tax.

Ad Get In-Depth Property Tax Data In Minutes. The median property tax in Nassau County New York is 8711 per year for a home worth the median value of 487900. Are You Confused About Your Property Taxes.

Request Your Tax Grievance Form Today. Processing applications for property tax exemption and the Basic and Enhanced STAR programs for qualifying Nassau County homeowners. In New York State the real property tax is a tax based on the value of real property.

Ad Authorize Maidenbaum To Challenge Your Nassau County Property Tax Assessment Now. How to Challenge Your Assessment. Nassau County collects on average 179 of a propertys assessed.

Such As Deeds Liens Property Tax More. The new york state sales. Pushback Over Nassau Countys New Property Tax Reassessment As Homeowners Get School Tax Bills December 14 2020 631 PM CBS New York ROCKVILLE.

Are You Confused About Your Property Taxes. Assessment Challenge Forms Instructions. See detailed property tax information from the sample report for 7 Bluejay Ln Nassau County NY.

This viewer contains a set of property maps of every parcel within the County of Nassau. 3 discount if paid in the month of December. What are the property taxes in Nassau County NY.

Nassau County collects on average 179 of a propertys assessed fair market value as property tax. Access property records Access real properties. Ad Need Property Records For Properties In Nassau County.

Ad Authorize Maidenbaum To Challenge Your Nassau County Property Tax Assessment Now. Fixing Nassau Countys Broken Assessment System - March 2 2020 2020-21 Market Value 1. 36724 for school Nassau County and Oyster.

69 rows the nassau county sales tax is 425. This statement is an update based upon 2019-20 levies. Nassau County has one of the highest median property taxes in the United States and is.

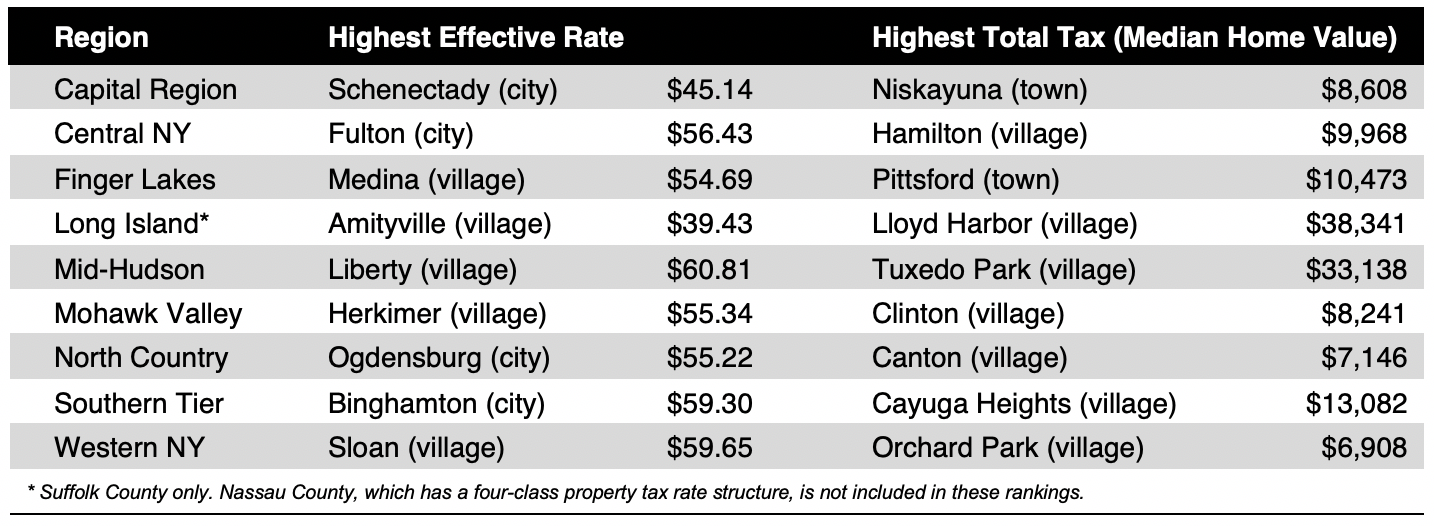

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Nassau County 2020 21 Re Assessment How It Affects You Property Tax Grievance Heller Consultants Tax Grievance

Taxing Authorities Citrus County Tax Collector

Compare Your Property Taxes Empire Center For Public Policy

Calculate Your City Of Fernandina Beach Property Taxes Fernandina Observer

Ny Ended The Property Tax Relief Checks Why They May Not Come Back

Budget Report Fy 2019 20 Village Of Westbury Ny

5 Myths Of The Nassau County Property Tax Grievance Process

Property Taxes Levied On Single Family Homes Up 5 4 Percent Attom

Pravato School Property Tax Deadline Extended To June 1st Town Of Oyster Bay

Make Sure That Nassau County S Data On Your Property Agrees With Reality

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

Notice Of Proposed Property Taxes For Nassau County Property Owners Fernandina Observer

New York Property Tax Calculator 2020 Empire Center For Public Policy

95026 Paso Robles Court In 2020 Property Real Estate Amelia Island

Video As The Year Winds Down Signs Of An Economic Slowdown Video Signs Wind